With the mortgage industry rapidly evolving, streamlining commission processes is no longer just a competitive advantage—it’s essential for attracting and retaining top loan officers. For too long, the market for commission management software has been dominated by enterprise-level solutions, leaving mid- to small-sized brokerages without an affordable, specialized option. EpochOS changes the game by offering modern loan officer commission software designed for brokerages of all sizes. This powerful yet affordable solution transforms how brokerages manage compensation, automate calculations, and simplify workflows, giving smaller teams the tools they need to compete and thrive in today’s market.

Why Loan Officer Commission Software Matters

Loan officer commissions are a critical component of compensation in the mortgage industry, directly impacting recruitment, retention, and overall job satisfaction. However, accurately calculating these commissions can be a complex process, requiring consideration of multiple variables like loan types, funding sources, and team roles. Without a reliable system, brokerages often turn to manual processes or spreadsheets, which are time-consuming and prone to errors.

These inefficiencies can lead to delayed payments, strained relationships, and unnecessary costs. Mistakes in commission tracking not only damage trust with loan officers but also reduce operational efficiency and hinder a brokerage’s ability to compete in a fast-paced market. Additionally, a lack of transparency in earnings can frustrate loan officers, affecting morale and creating potential compliance risks.

EpochOS offers a modern solution to these challenges, streamlining commission management with automation, transparency, and accuracy. By addressing the complexities of commission calculations, brokerages can focus on growth, efficiency, and providing a seamless experience for their teams.

Loan Officers Love Using EpochOS

EpochOS isn’t just a tool—it’s a game-changer for loan officers. By simplifying complex processes and providing real-time insights, it empowers users to focus on what truly matters: growing their business. But don’t just take our word for it—hear from those who use it every day.

“As an LO, this was such a huge improvement for me to be able to see/project closings, income, expenses! Love, love, love it!! 🥰”

— Gay Lynn Carter Veale, Loan Officer

Ready to experience the same transformative results? See what our customers are saying.

The Challenges of Manual Commission Management

Many mortgage brokerages still rely on spreadsheets or outdated systems for tracking commissions. While these methods may seem cost-effective, they often result in significant inefficiencies and challenges, including:

These challenges don’t just create headaches—they come with hidden costs that can drain time, money, and resources from your brokerage. While manual processes may appear affordable on the surface, the inefficiencies they introduce can significantly impact your bottom line. To truly understand the scope of these costs, let’s break it down.

The Hidden Costs of Manual Commission Management

For mortgage brokerages relying on manual processes, the inefficiencies quickly add up. Before transitioning to EpochOS, many brokers reported significant time and resources spent managing commissions each month. Let’s break it down:

HOURS WASTED MONTHLY

ON MANUAL CALCULATIONS

HOURS SPENT WITH

EpochOS AUTOMATION

These inefficiencies don’t just waste time—they directly affect your bottom line. Whether it’s minimizing errors, reducing payroll costs, or reclaiming hours for more strategic initiatives, commission software like EpochOS transforms your operations and creates a smoother experience for both your brokerage and your loan officers.

How EpochOS Commission Software Provides Strategic Benefits for Mortgage Brokers

Modern commission management software transforms how brokerages handle compensation by eliminating manual processes and reducing errors. By automating calculations and providing a centralized platform for tracking and reporting, it empowers mortgage brokers to work more efficiently, build trust with loan officers, and focus on growth. Here’s how it can make a real difference:

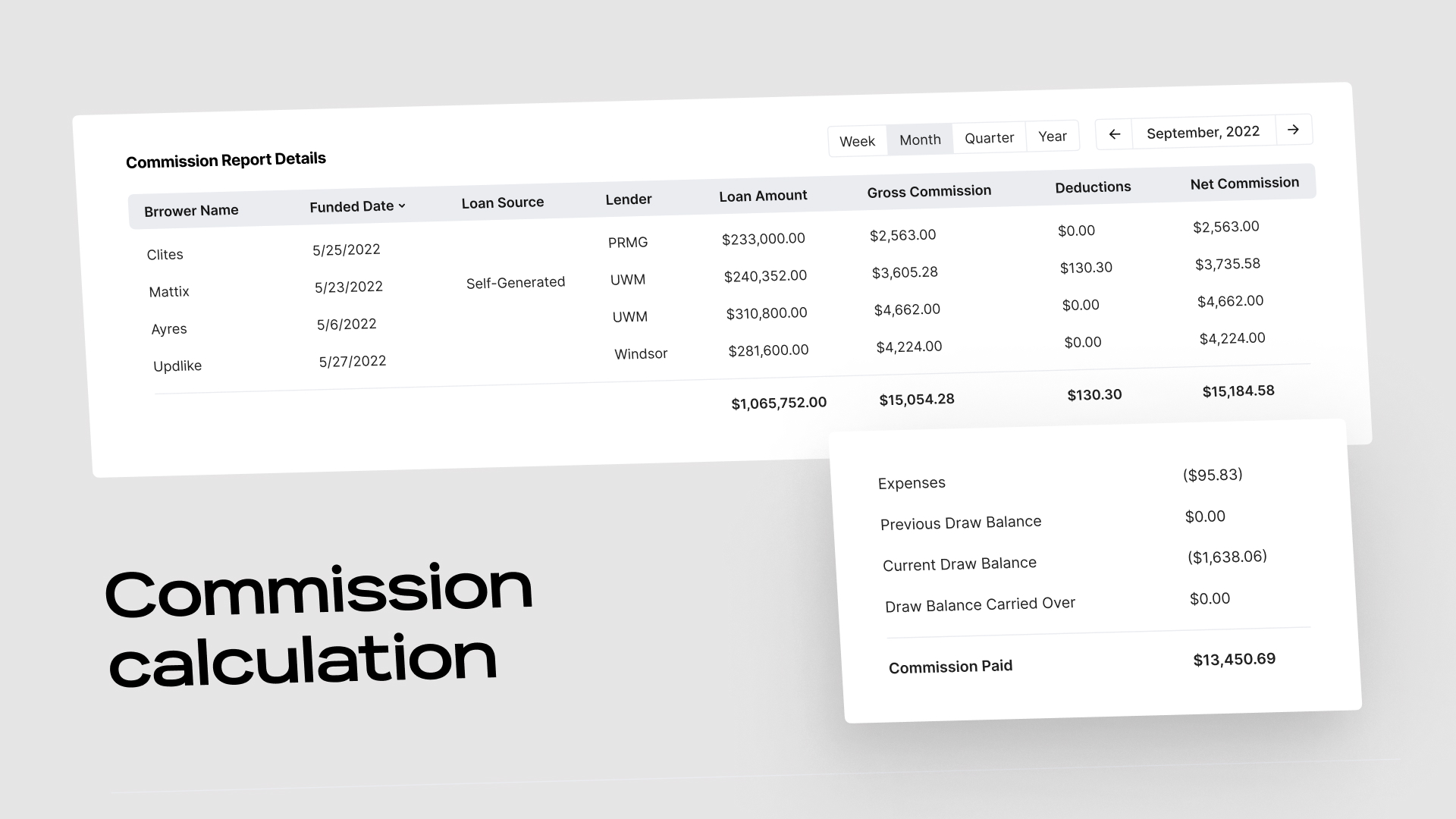

Accuracy and Automation

Automate commission calculations to eliminate errors and ensure compliance with compensation agreements.

This automation reduces calculation errors by 99.8%.

Transparency for Loan Officers

Provide real-time access to commission statements, ensuring clarity and trust.

Customization for Brokerage Needs

Adaptable to unique compensation structures, including tiered commissions and team splits.

Time Savings

Free up administrative staff and loan officers to focus on revenue-generating activities.

This software cuts processing time by 85%.

By leveraging these features, EpochOS empowers mortgage brokers to enhance accuracy, improve transparency, and optimize workflows. Whether you’re streamlining operations or boosting productivity, EpochOS is the trusted partner for driving performance and growth in your brokerage.

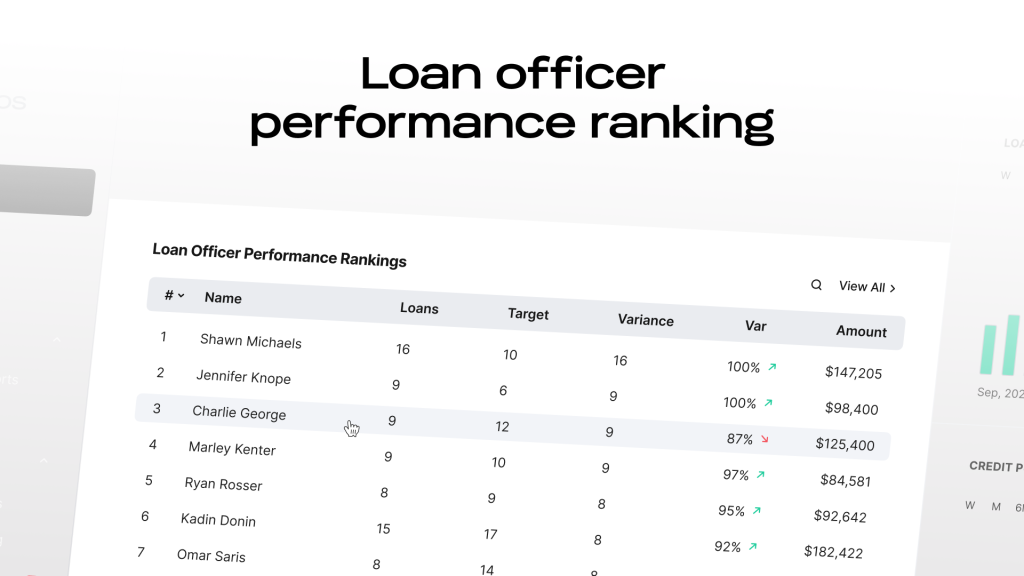

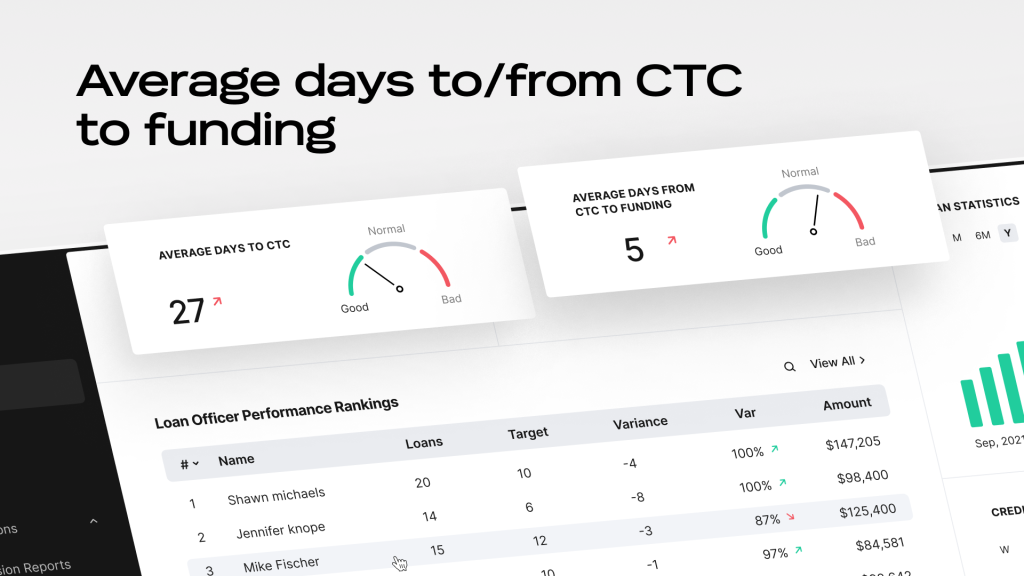

Data-Driven Performance Management

In today’s competitive mortgage market, data is key to driving success. EpochOS commission tracking software empowers brokerages with actionable insights through advanced dashboards and analytics, helping you optimize team performance, uncover growth opportunities, and make informed decisions with confidence.

EpochOS mortgage broker software provides:

Real-time Performance Dashboards

Access real-time data to monitor loan officer and team performance effectively.

Automated Commission Reporting

Commissions reports show commission as soon as loans fund.

Productivity Metrics

Measure and track productivity to ensure efficient use of time and resources.

Revenue Forecasting Capabilities

Leverage data to accurately predict revenue and make informed decisions.

With these tools, EpochOS doesn’t just provide data—it delivers actionable insights that empower brokerages to stay ahead in a competitive market. But the advantages of EpochOS go even further, redefining commission management with features designed to simplify workflows and drive strategic growth, using our commission software for loan officers and mortgage brokers.

The EpochOS Advantage: Beyond Basic Commission Management

In today’s competitive mortgage landscape, commission management demands more than just basic tracking. It requires intelligent tools that can adapt to the complexities of modern brokerages. EpochOS stands out by delivering advanced solutions that automate workflows, integrate seamlessly with existing systems, and provide data-driven insights to fuel strategic growth.

Intelligent Automation

- Custom rule engines that adapt to complex commission structures

- Smart exception handling for special cases

Integration Capabilities

- Seamless connection with existing LOS systems

- Real-time data synchronization

- Automated reporting to accounting systems

Strategic Insights

- AI-powered performance analytics

- Loan officer performance optimization

With its unique blend of automation, integration, and analytics, EpochOS transforms commission management from a time-consuming chore into a streamlined, strategic advantage. Empower your brokerage to operate with greater efficiency, transparency, and confidence in a rapidly evolving industry.

EpochOS Commission Software: Solving Bottlenecks with Measurable Results

Efficient operations are the backbone of any successful mortgage brokerage, but managing commissions, tracking performance, and ensuring compliance can be overwhelming without the right tools. EpochOS simplifies these challenges with a robust feature set designed to eliminate bottlenecks, optimize workflows, and deliver measurable results. From flexible commission structures to seamless system integrations, EpochOS empowers brokerages to operate smarter and more efficiently.

Flexible Commission Calculations

- ✓ Design custom commission structures based on loan type, volume, or revenue

- ✓ Configure tiered commission rates for different performance levels

- ✓ Set up complex split arrangements between team members

- ✓ Apply automatic fee deductions and adjustments

- ✓ Handle draws and minimum guarantees

Advanced Performance Management

- ✓ Track real-time production metrics and loan pipeline

- ✓ Monitor individual and team performance

- ✓ Generate automated commission statements

- ✓ View historical trends and analysis

- ✓ Access mobile-friendly dashboards

Seamless System Integration

- ✓ Connect with popular Loan Origination Systems

- ✓ Import data from multiple file formats

- ✓ Integrate with accounting platforms

- ✓ Enable secure API connections

- ✓ Automate data validation

Administrative Controls & Compliance Support

- ✓ Pre-configured user roles (Admin, Non-Admin, Contractor)

- ✓ Commission documentation management

- ✓ Historical commission record keeping

- ✓ Commission structure best practices

With these advanced tools, EpochOS doesn’t just streamline operations—it transforms how brokerages approach commission management and team performance. By addressing common pain points and delivering powerful, quantifiable results, EpochOS loan officer commission software sets the stage for growth and operational excellence. Ready to redefine your mortgage operations? Discover how these features can revolutionize your brokerage.

Transform Your Commission Management in Days, Not Months

Immediate Impact

- ✓ Commission calculations automated within 24 hours

- ✓ Zero manual calculation errors

- ✓ Instant commission visibility for loan officers

30-Day Transformation

- ✓ Save 15+ hours per month on commission management

- ✓ Real-time commission tracking and reporting

- ✓ Improved loan officer satisfaction

Sustained Growth

- ✓ Increased loan officer retention

- ✓ Data-driven commission decisions

- ✓ Scalable commission management

Transform Your Mortgage Business with Modern Commission Management

In today’s competitive mortgage industry, efficient commission management isn’t just about payroll—it’s about empowering your team and driving growth. As margins tighten and talent retention becomes increasingly crucial, modern commission management software has evolved from a luxury to a necessity.

EpochOS’s loan officer commission software transforms traditional commission management from a time-consuming administrative burden into a powerful strategic advantage. By automating calculations, providing real-time visibility, and delivering actionable insights, our platform helps mortgage brokerages:

- ✓ Eliminate manual calculation errors and save countless hours

- ✓ Attract and retain top loan officers with transparent commission structures

- ✓ Make data-driven decisions to optimize commission plans and boost productivity

The future of mortgage commission management is here, and it’s automated, transparent, and growth-focused.

Ready to Transform Your Commission Management?

See how our loan officer commission software can streamline your operations in less than 24 hours.